By: Richard W. Sharp and Patrick W. Zimmerman

Is your representative representative of YOU?

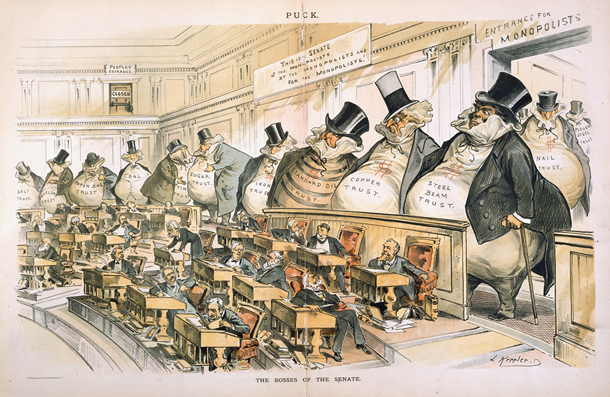

While you might share political views, you probably do not share your elected officials’ standard of living. As Republicans shape a new tax structure “for the middle class,” can we expect them to understand and empathize with the middle class?

Ahahahahahaha, of course not. Congressional representatives are better models of the 1% than the middle class (the $174,000/yr base salary alone gets you in the top 10%, and most members didn’t get their start as starving artists).1

While Republicans are in the driver’s seat for the tax debate and Democrats will have to oppose it for political and theoretical reasons, there’s a catch. The Democrats fighting for the “little guy” are just as absurdly wealthy as the “fat cat” Republicans they are resisting. Despite 535 individual stories of pulling oneself up by one’s bootstraps, repeated ad nauseum at rallies, on TV, and in debates (probably to the point where the teller may actually believe it), neither party represents the middle class.

Why do Treasury Sec Mnuchin and his wife insist on posing for photos that make them look like Bond villains? pic.twitter.com/2auZr3LGoP

— Christina Wilkie (@christinawilkie) November 15, 2017

So what’s it call when you combine serendipity and schadenfreude? The original inspiration for this piece was the tax plan that is swirling around the halls of the Capitol. We wanted to know what was personally at stake for the members who would be voting on it. Since the bulk of the proposals amount to a giveaway to business at the expense of people who get their money from a salary (you know, people who work for a living), the prospect arose that many Republican representatives would be voting for a bill that would hurt them personally. But in the end we discovered something unexpected (serendipity), which is that they are outliers on the wealth curve, but the tax credits they intend to slash just don’t show up on their returns as earned income (schadenfreude). OK, OK, we really shouldn’t have been surprised that Congress has a money problem. The surprise lay in its pervasiveness.

The question

What legitimacy do the members of Congress have to write a tax law?

The Constitution? Well that gives them a legal right to vote and pass a tax proposal, but by what authority? Do they have either theoretical expertise or a working understanding of the affects of such a law?

Are Republicans, who have constructed the law in secret conference with the President and without public debate or the critique of credible experts, able to understand its consequences because it will impact their lives in the same way that it will affect most Americans?

Understanding creates compassion, and without it the only likely result is a deeply flawed bill. So let’s settle on a succinct version of the question: “Are Republicans either expert economists or members of the middle class?“2

The short-short version

Our government is especially unsuited to make informed decisions that affect how the great majority of the governed manage their financial well being because it consists of so many people who have, at best, a theoretical understanding of middle class life. They have neither the training nor the empathy that comes with shared experience to understand the day-to-day economic struggles of their average constituent.

By the way, this piece doesn’t even include he who will not be named. T**** is rich, and he does wield political power (clumsily), but today we’re focused on the Legislative Branch, for two reasons.

- All laws regarding taxes must originate out of the House of Representatives.

- Trump is such an outlier that he throws off a not-that-large sample.

The wealth curve

To answer the question, we focused on the wealth distribution. Congressional salaries are public information, but they form a very incomplete picture of the finances of the wealthy. So, how does Congressional wealth compare to the peoples’? Let’s go to the charts.

This is one of those good charts that instantly answers the question. Does the Congress curve lie to the right of the people’s curve?

Yup = Congress is rich, really rich. Swimming-in-a-big-pool-filled-with-$100-bills rich.

…And we used the lowest possible estimate for wealth (see below).

The 25th percentile in Congress is very close to the median for the rest of us. The Congressional median lies at about the 80th percentile for the people. Half of the folks in Congress have a greater wealth than 80 percent of the people they “represent.” Since we used the minimum estimated wealth for the lawmakers, the actual curve lies further to the right and the real comparative values are more extreme than these. About now, you should be yelling “No taxation without representation!” at your screen.

Too complicated for you? Let’s simplify! Here’s the 25th, median, and 75th percentiles for wealth, comparing Congress and the American People. We’ve even removed the logarithmic smoothing on the y axis and just given you good ol’ fashioned dollars.

Rarely has it been so obvious how governed we are by the wealthy (and pretty much only them). And you expect them to look out for body politic as a whole?

It’s good to be the Legislature.

Maybe they know what they’re doing?

OK, they’re rich, but that doesn’t necessarily mean the don’t know how taxes impact the economy and individual people’s lives. They could be experts on tax policy, right?

Well, we can make short work of this argument by looking for some economists in Congress. What’s an economist?3 Somebody who spent significant time as a practitioner before moving on to politics (playing one on TV doesn’t count, nor does writing Ayn Rand fan-fic and developing a wonkish political persona, sorry Ben Stein and Paul Ryan). So here’s the list:

- Dave Brat (R) VA 7th

While Dave Brat does sit on the Budget Committee, he is not a member of the House Ways and Means Committee or leadership. So he’s not exactly in a position to have significant influence on tax policy.

The exciting world of the congressional financial disclosure report

So now that we’re done with “they’re experts,” (all one of him) let’s move on to “they’re subject to taxes too, so they’ll understand how it affects the people.”

For this, we examined Congressional financial disclosure data (House, Senate) in order to see how the personal finances of Congress reflect that of most Americans. In particular, we’re interested their personal wealth and the sources of their money (earned vs. investment). Most Americans earn a salary, and most of that goes to paying the bills. Only a fraction of it ends up in the bank. Are the members of Congress people who earn money for a living or do they simply receive it?

Along the way, some observations about the effectiveness of the current financial disclosure forms cropped up. Spoiler alert: they’re not tax forms and (thus) a wee bit vague.4

The main reason that financial disclosure statements aren’t that revealing on an individual level is that all assets are given a wide range of potential values. Why does this matter? Well, it makes it hard to understand what an individual is really worth. Case in point: Nancy Pelosi.

So we took the low estimate, just to be safe.

Nancy Pelosi has been in Congress since 1987. This means we know her public salary over three decades. We also have her financial disclosure reports. Due to the nature of the financial disclosure form, her total wealth (2015 numbers) is somewhere between $9.4M and $191.9M.

Um….what? Not that either one of those numbers is chicken-feed, but wow, what a huge range of possibilities. Is it even feasible to accumulate that kind of money on a Congressional salary? We decided to find out.

By using historical salary data and making assumptions about initial wealth, monthly savings rates, taxes, and interest earned several scenarios led to numbers ranging from $2.4M to $8.1M. Any of these numbers is consistent with the low end $9.4M estimate (after all, we assumed she started from $0 at age 37, didn’t factor in her husband, and have nothing to say about the price of her home which is presumably subject to a few decades of San Francisco real estate insanity). So at the low end, these scenarios seem possible. But if the true value is at the high end of that range, it would be time to call on Robert Mueller’s team to follow the money. All in all, this casts more light on the financial disclosure process than on Nancy: it isn’t a detailed report.

The Nancy Pelosi exercise shows us that it’s going to be hard to get an accurate estimate of a Congressman’s wealth from a financial disclosure report. The range of possibilities can be so wide as to be useless, and in the case that we took a look at, it seems far more likely that the minimum value, not the mean, max or some other statistic is the most realistic. In order to compare the wealth of Congress to the rest of us (the Wealth Curve), we’ll took the most pessimistic of views and used minimum wealth estimates for Congress. Whatever the true value, we can reasonably say that it’s “at least this much.”

Fortunately, finding the wealth distribution for the general population was much easier. We used this data from the Urban Institute.

Conclusion

No, Congress does not look like a representative sample of Americans with respect to personal finance.

No, the Republicans in Congress are not tax experts, have not consulted independent experts, held public hearings, or sought comment from the public that will suffer the impact of their experiment.

They will not suffer the short term impacts (tax of college tuition, state tax deduciton, mortgage deduction), some will reap the short term benefits (pass though income, lower rates, estate tax, elimination of the Alternative Minimum Tax), and none will own up to the long-term costs (next year’s budget cuts that will have to come to pay that $1.5T – TRILLION!!! – bill that’s coming due).

They are not fit to propose a tax bill.

What’s next?

Ok, we know Congress is stinking rich. But is it prone to corruption, too?

Let’s take a gander through the Paradise Papers and see if we can’t do some text matching between known shell companies and congressional financial disclosure forms, hmmm? Sure, it’s a fishing expedition, but even a negative is an interesting finding.

Notes:

1 Even when they’re not. You don’t have a net worth of -$24M dollars because you’re poor (David Valadao, CA-21. Congratulations, you’re last place on the wealth ranking!). ^

2 We by no means want to exclude Democrats here. They have neither more expertise nor less money than Republicans (they have slightly more, on average. $7.77M to $7.57M). But they lost, so they’re not writing the tax law. ^

3 Why are only economists qualified? They have all those businessmen, so they must know about taxes. Well, that’s rather one-sided….about as one-sided (and earily reflective of) the bill currently in front of Congress.^

4 Step up to the plate, Mr. President. If you want American’s to trust you, let’s see some proof, or, as one tax-loving, high-spending liberal famously said “Trust, but verify.” ^

No Comments on "No tax reform without representative representation"